While many Gen Z and Millennials are reportedly moving away from alcohol consumption altogether, some view wine as a promising investment opportunity. Businesses are also eager to capitalize on this trend.

WineFi, partly owned by Coterie Holdings—led by Michael Saunders, a notable player in the wine industry—has garnered attention since its launch last autumn.

“We were introduced to the team at Coterie very early in our development, and both sides recognized there was a mutual fit,” explains WineFi CEO Callum Woodcock, who comes from an asset management background. “From our perspective, there’s a huge benefit to being part of an ecosystem. We can store with Coterie Vaults, we can source and broker wine through Lay & Wheeler and Coterie’s other merchants, and even offer certain clients the ability to borrow against the value of their portfolios with Jera.”

“The relationship also lends WineFi a lot of credibility,” suggests Woodcock. “I am very grateful to be working with some of the ‘big beasts’ within the wine trade, as well as some really trusted brands, and I think that has made a lot of people sit up and take notice of what we are doing.”

The audience that WineFi is particularly keen to engage is younger investors—those who do not fit the traditional mold of fine wine buyers.

The Appeal of Early Investment

Woodcock emphasizes the importance of timing in wine investment: “If you are investing in wine for anticipated financial gain, rather than simply collecting it, I think the most solid argument for investing young is the time horizon. Wine is a medium-long term investment, with a holding period of anywhere from five to seven years. Investing young, especially if you plan on keeping wine as a static percentage of a wider portfolio, allows you to realize liquidity on a rolling basis. This might not necessarily be the case for someone later in life.”

Another advantage of wine investment for younger people, according to Woodcock, is its conversational appeal: “You can talk about it at a dinner party in a way that you can’t talk about your S&P 500 index fund!”

Adapting to a New Generation

To resonate with a younger audience, it’s essential to adapt communication strategies. A recent survey revealed that nearly a quarter (23%) of 18-34-year-olds ‘never’ answer phone calls, and 61% prefer messages over audio calls.

“It is as alien to younger people to have to call up your wine broker to add to your wine portfolio as it is to call up your stock broker to add to your equity portfolio,” explains operations director Oliver Thorpe. He adds that younger investors “want to be able to align with a brand on a much more personal level.”

“They like to know that the company they’re working with has values that mirror their own, and they want to put a face to a brand. Big corporations have cottoned onto this too, which is why you can see them on social media sharing memes under popular posts. We’ve found that sharing our journey and being open about who we are, what we do, and why we do it resonates well,” says Thorpe.

The role of social media raises questions about whether trends like Non-Fungible Tokens (NFTs) and Cryptocurrency, which appeal to a tech-savvy younger generation, could encourage wine investment. According to Woodcock, “Through an investor’s lens, tokenization allows for portfolios of wine to be fractionalized. Not only does this lower the financial barrier to entry, but it also allows for those tokens to be traded on the secondary market – ‘on chain.’”

“This gives sellers access to a very large liquidity pool, essentially the entire crypto market,” he continues. “The issue is that regulation has not yet caught up with technology, so I think it will be a few years before we see anything like this. When we do, though, I promise it will be WineFi doing it.”

Who Are WineFi Investors?

Thorpe describes the typical WineFi investor as “working-age, financially savvy professionals who already have an investment portfolio and want to diversify further into alternative assets. They are lawyers, bankers, salespeople, consultants, founders, etc.—so a fairly elite group.”

This indicates that many wine investors may not be particularly passionate about wine itself—especially since reports suggest that Gen Z is increasingly abstaining from drinking—but rather focused on financial gain.

James Kowsun, managing director of fine wine merchant Lay & Wheeler (also part of Coterie Holdings), refers to these investors as “HENRYs”: “High earners, not rich yet— in recent years we haven’t seen that conversion of young people into wine drinkers, so we have some work to do.”

“Traditionally, to get into wine investment, you’d start as a drinker and then buy bottles to invest in,” explains Woodcock. “What we’re seeing is the opposite: you start as an investor, and then, because it’s the most interesting part of your portfolio, you start to drink it. That’s how I got into wine!”

Thorpe notes that while the majority of investors are based in the UK—where profits from wine investment are exempt from capital gains tax—there are also investors from around 16 countries, including Singapore, Hong Kong, and the US.

“The average age of an investor on our platform was 36 for a long time but has recently started to rise as we become more universal. Our investor base is mostly male, but an increasing percentage is female. We’re working on that,” he says.

What Are Young People Investing In?

The multimillion-pound question, particularly concerning the future of fine wine producers, is: What are these younger investors actually putting their money into?

Interestingly, there aren’t many surprises regarding the regions attracting young investors. “Of the more traditional investment regions, the likes of Champagne, Tuscany, and Burgundy definitely appeal to the younger generations,” shares WineFi head of data Aaran Daniel, noting Champagne’s “unique place in popular culture” and Burgundy’s “scarcity” and “mystique.” He adds, “Not to mention, its returns over the last 20 years are hard to ignore!”

“Burgundy and Champagne have been cooling down after the post-Covid excitement, but there are definitely signs suggesting that wine labels are returning to their long-term price trends,” Daniel observes. “Some good deals are to be found now in these regions—quality and interest in these wines is as strong as ever.”

“In a recovering wine market, it’s hard to overlook Tuscany and Italy as a whole,” he adds. “Piedmont and Tuscany have shown remarkably consistent price appreciation over the last 20 years and continue to release excellent vintages. Our analytics on Italy show a healthy balance with growing secondary activity, and we have every reason to think that will continue.”

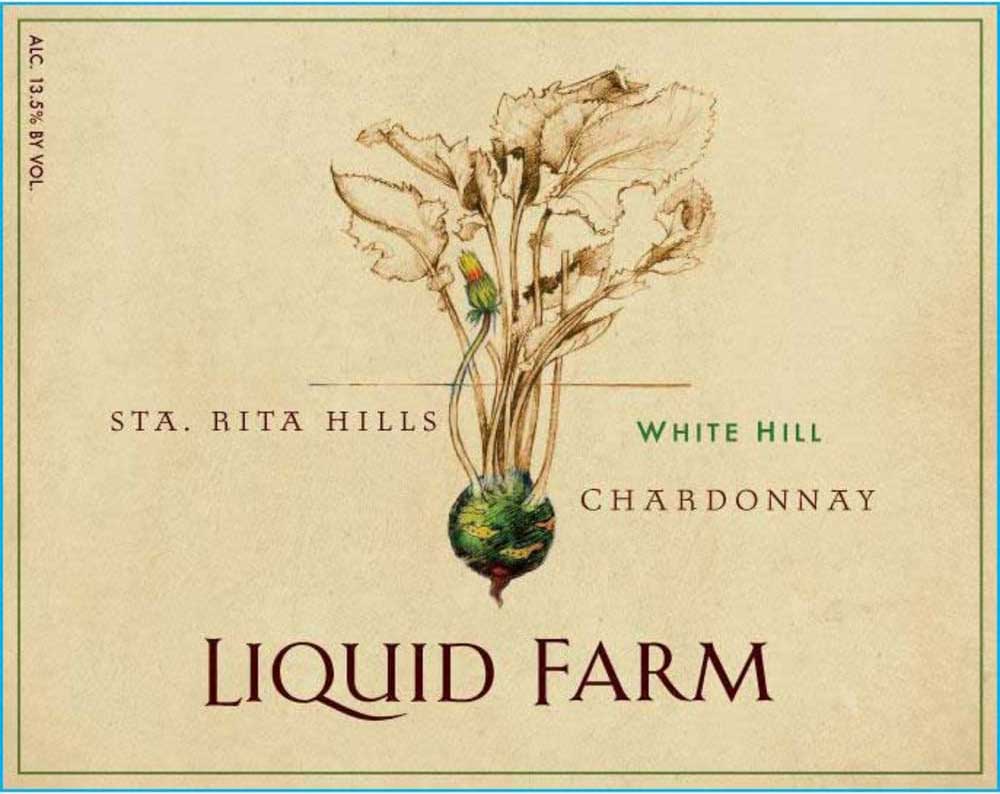

“For those looking for more affordable options, younger investors are definitely turning to regions like Argentina, Rioja, and South Africa. Especially those taking a ‘drink some, invest some’ approach. In Argentina, you can buy a 100-point vintage for a fraction of the price. There’s an increasing secondary market for these wines, and there’s no reason that trend won’t continue,” he adds, expressing optimism about the “left-field” choices of Argentina and South Africa.

Whether young investors can rejuvenate the fine wine market, currently in a slump, remains to be seen. As industry insiders speculate, it raises the question of whether we have finally hit rock bottom.